25+ Commercial mortgage rates

Refinancing commercial real estate can help you avoid making such a big payment at one time. 5125 down from 5625 -0500.

:max_bytes(150000):strip_icc()/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

30-year fixed mortgage rates.

. The more money you can invest yourself the better as borrowing with a lower Loan To Value. Marys Bank Checking Account. Rates are subject to change without notice at any time.

30-year fixed mortgage rates. Click here to view our mortgage rates. The interest rate on commercial mortgages is typically 4256.

Offer may change or be withdrawn at any time without notice. Based on data compiled by Credible mortgage rates for home purchases have fallen across all terms since last Friday. You can borrow money tax-free with a cash-out refinance.

Corporate. Rates assume a 40 down payment and a credit score of 740 or greater. A minimum of 25 deposit is required although some lenders require more.

Search Opens a dialog. 2 Cashable after 12 months at 200. Corporate Commercial Return to Main Menu.

The commercial mortgage rates displayed in this website should be used as a guideline and do not represent a commitment to lend. Banks current mortgage rates in Minnesota and see how residing in different states can impact your loan. Todays commercial loan rates can average between 450 and 1648 depending on the loan product.

Have a browse through our. VA IRRRL rates and guidelines. Commercial Mortgage Interest Rates.

View daily mortgage and refinance interest rates for a variety of mortgage products and learn how we can help you reach your home financing goals. Commercial loans have shorter repayment periods than traditional mortgages usually five to 25 years compared with 30 years for a residential mortgage. The series is the average contract rate reported by a sample of mortgage lenders-- savings and loan associations savings banks commercial banks and mortgage companies -- for loans closed during the first 5 working days of the month up through October 1991 and for the last 5 working days of the month since November 1991.

6 Cashable after 12 months at 350. Learn more about US. Commercial mortgage rates start from just 275 pa - 2 over Bank of England Base Rate Commercial Mortgage Interest Rates.

The fixed and variable rates shown below are applicable from 24 th February 2022. Most terms are 2025 years and will vary by lender. 5 Cashable after 24 months at 275.

Other conditions and restrictions apply. Are based on a fixed-rate period of 5 years that could change in interest rate each subsequent year for the next 25 years a down payment of 20 and borrower-paid. The higher your credit score the easier it is to open the door to a lower interest rate.

Home Loan Interest Rates. A business mortgage usually lasts from three to 25 years and you can usually find a 70-75 mortgage. The interest for fixed rate mortgages is calculated semi-annually not in advance.

Interest rates and annual percentage rates APR are two different ways of expressing the fees a borrower incurs when taking out a mortgage. VA Streamline Refi 2022 March 25 2022 FHA Streamline Refinance. The most popular residential mortgage product is the 30-year fixed-rate mortgage but residential buyers have other options as well including 25-year and 15-year mortgages.

Rates vary based on how long youve been in business and your credit score. 3 Mortgage rates above reflect loans for single family detached owner occupied-residential properties. Rates Requirements for 2022 April 14 2022 The Best Mortgage Refinance Companies for 2022 June 9 2022.

Typically the term or length of a commercial mortgage can be anywhere from 1-10 years with limited exceptions for longer terms on self-amortizing loans such as SBA loans up to 25 years insurance or Fannie Mae loans up to 30 years or FHA loans up to 35 years for refinance or 40 years for construction to permanent financing. There are two main choices available fixed or variable rate. If you are purchasing a rental property or secondary home or have an amortization of greater than 25 years a premium of 050 is added to the above interest rates.

3 Cashable after 12 months at 225. This is a measure of loan-to-value ratio to see how much youre borrowing in relation to how much the property is worth. Loan Type APR Maximum Amount Maximum Term Maximum L-T-V.

4 Cashable after 12 months at 250. Selected Personal Investing. Based on data compiled by Credible three key mortgage rates for home purchases have risen and one remained unchanged since yesterday.

1 The rates listed above include a 125 reduction for having an Automatic Funds Transfer of your mortgage payment from a St. Interest rates will have an impact on your mortgage term and how much you will repay each month so its a good idea to get familiar with them. Navegó a una página que no está.

Interest rate relates to the cost of borrowing stated as a percentage on the principal amount of a mortgage. Interest Rate For Loans Max LTV Lender Facility Fee. If you are refinancing your mortgage a premium of 015 is added to the above interest rates.

025 discount with Lee Bank Relationship and Autopayment. Commercial Loan Direct and CLD Financial.

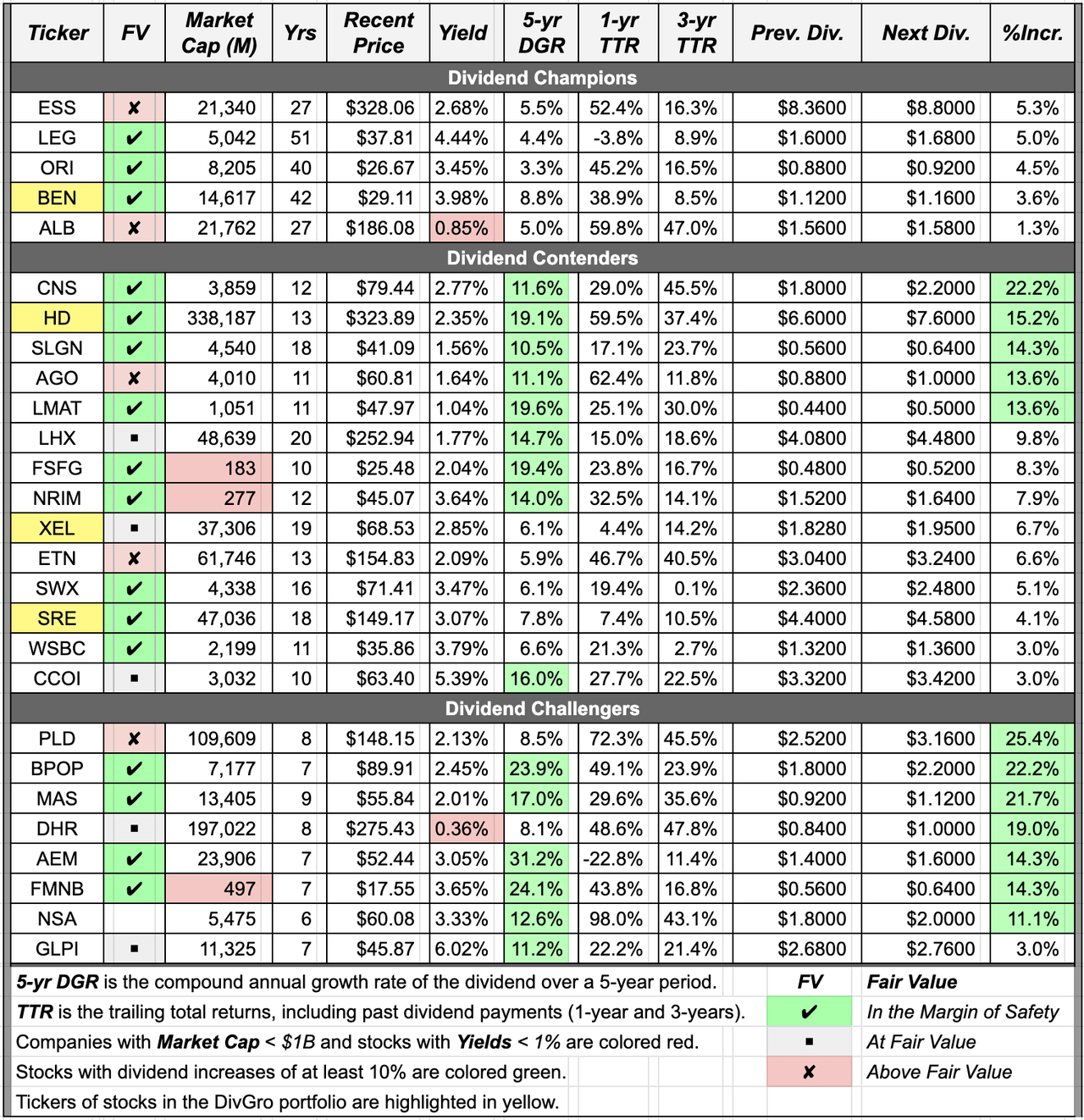

Dividend Increases February 19 25 2022 Seeking Alpha

Https Em Angieslist Com 5 Roofing Scams To Avoid M Angienewsletter Entry Point Id 33163140 Cid Eml E007 M001 Green 20180 Roofing Roof Cost Hurricane Season

Mortgage Daily Mortgage News Rates Tips And More

Container Swimming Pool 6 Container Pool Shipping Container Pool Backyard Pool

Lease Renewal Gift Ideas Apartment Marketing Moving Gifts Apartment Advertising

25 Ways To Make Money As A Real Estate Agent Real Estate Tips Real Estate Agent Real Estate Agent Marketing

2

Technology Pack Free Outline Versions On Behance Technology Outline Start Up Business

Best Refinance Offers 25 Years Of Experience As Reliable Second Mortgage Broker In Mississauga

Fed S Senior Loan Officer Survey Reflects More Normal Economy

1st Florida Lending I No Doc Hard Money Loans

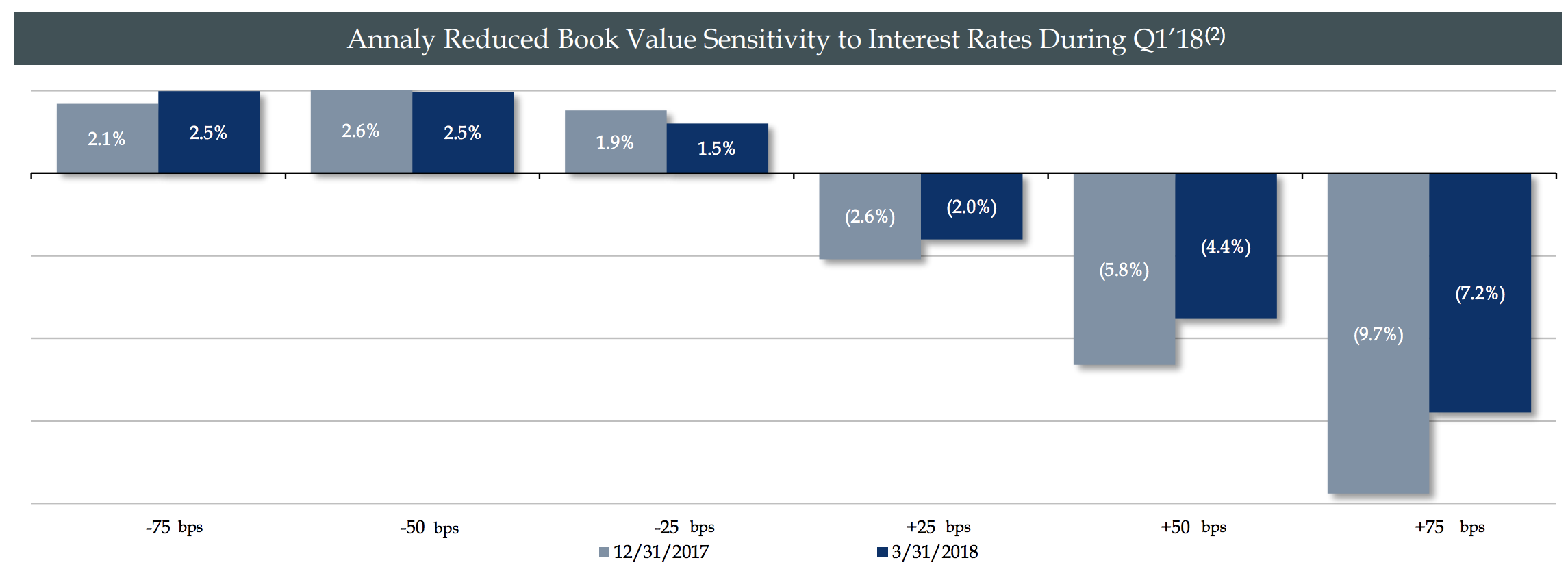

A Guide To Investing In Mortgage Reits

Sherry Madigan Origination Servicing Quality Control Manager Vice President Old National Bank Linkedin

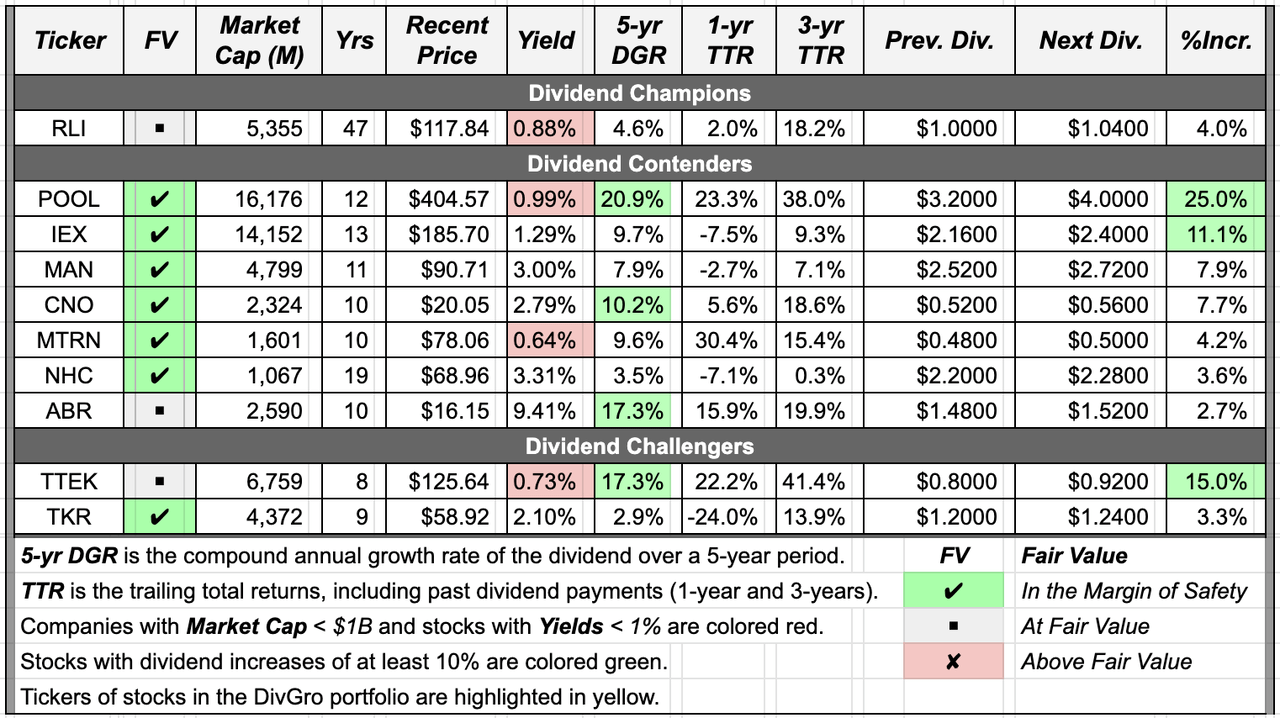

Dividend Increases April 30 May 6 2022 Seeking Alpha

Fed S Senior Loan Officer Survey Reflects More Normal Economy

Fed S Senior Loan Officer Survey Reflects More Normal Economy

Iterations Of Score Indicators Data Visualization Design Scores Data Visualization